North Sumatra Investment Report in Quarter IV of 2020 is Getting Better

By : Zulfansyah

14 February 2021 07:57 PMNorth Sumatra investment realization in the fourth quarter of 2020 is getting better despite contraction and tends to ramp up. Gradual improvement continues to be pursued in line with the ratification of the Omnibus Law as a target to restore investor confidence in conducting investment activities.

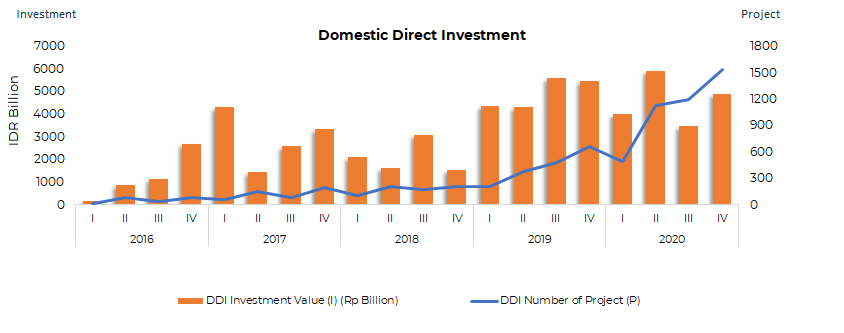

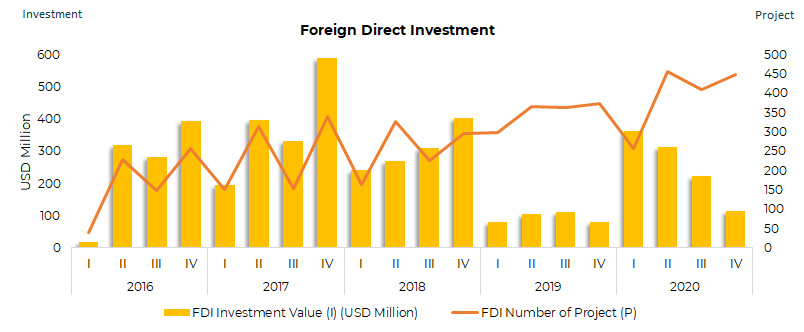

Realization of PMDN and PMA Quarter IV Year 2020

The improvement can be seen from the growth of Foreign Direct Investment (FDI) receipts in North Sumatra by 41.59% (yoy) compared to the same period in the previous year. This indicates an increase in optimism from foreign investors. Meanwhile, the Domestic Direct Investment (DDI) growth tends to ramp down by -10.50% (yoy) to the same period in 2019 due to the Covid-19 pandemic. Nevertheless, DDI growth in the fourth quarter of 2020 has a positive growth of 41.38% (qtq) from the previous quarter due to optimism investors on the Indonesian economy which is predicted returning to normal and as the impact of the Covid-19 vaccination program. As cumulatively, the investment realization achievement of North Sumatra throughout 2020 reaches IDR 32.23 trillion whereas IDR 18.19 trillion is coming from DDI and IDR 14.03 trillion is from FDI. This achievement is above the target after revision due to the Covid-19 pandemic.

Realization of Labor Absorption

In the midst of improving conditions due to the Covid-19 pandemic, based on the acquisition, investment performance in the fourth quarter of 2020 was able to absorb a workforce of up to 833 people, with the details as many as 720 workers from Indonesia and 113 foreign workers with a total of 448 investment projects. Based on sectoral shows the Housing, Industrial Estates, and Offices sector absorb the highest number of workers as many as 165 Indonesian workers, followed by Other Services sector as many as 162 Indonesian workers and the Trade and Repair sector as many as 153 Indonesian workers and 3 foreign workers.

Sectoral Investment Growth Trends

Compared to the third quarter of 2020, the highest improvement trend for FDI in the fourth quarter of 2020 was indicated by improved investment performance in the Non-Metallic Mineral Industry sector (310.28%), Mining sector (109.14%), Construction sector (100%), followed by Food, Crops and Plantation sector (20.50%). It is predicted because these four sectors have the potential to provide high added value to the economy, but have a low risk of spreading Covid-19. While for the DDI, the sector that experienced the highest growth compared to the previous quarter is the performance seen from the increase in the Electricity, Gas and Water sector (777.41%), the Transportation, Warehouse and Telecommunications sector (426.45%), and the Construction sector (196.05%). The Electricity, Gas and Water sector also the Transportation, Warehouse and Telecommunications sectors are the crucial sectors and have a high impact on the economy, especially in the Covid-19 pandemic. Meanwhile, the Construction sector has shown positive impact in the fourth quarter of 2020 as indicated by the increase in investment realization by both FDI and DDI.

Investor's Country of Origin

Five largest project investors in North Sumatra in the fourth quarter of 2020, among others come from Singapore with a contribution of USD 80.17 million (70.63%); Hong Kong amounted to USD 12.18 million (10.73%); the Netherlands of USD 11.16 million (9.83%); Belgium of USD 3.78 million (3.33%); and Malaysia of USD 2.68 million (2.36%).

Distribution of Investment Realization by Regency/City

The distribution of investment realization in North

Sumatra in the fourth quarter of 2020 based on regency/city recorded in FDI is dominated by Mandailing Natal Regency (39.84%), followed by South

Tapanuli Regency (16.76%), and Dairi Regency (6.53%). Meanwhile, from DDI is dominated by Tebing Tinggi City (35.09%), followed by Langkat

Regency (24.59%), and then Deli

Serdang Regency (6.85%).

Development of Investment Realization in North Sumatra Province (2016 – 2020)

Start Invest in North Sumatra

Thousands of opportunities await, explore now to learn more.

START NOW